Management could also offer target-based financial incentives to salespeople or create more robust marketing campaigns to generate buzz in the marketplace for their product or service. No matter what your cost variance calculator looks like, the cost variance formula will be one which you use and lean on for projects all of the time. For some companies, their cost variance calculator is still excel or generic spreadsheets. They keep track of all negative cost variance of their data using paper forms, word docs and PDFs, and then transfer this data into spreadsheets where it can be used and placed into formulas like the CV formula. Now that we know what the cost variance formula looks like, we can show you can example of the CV formula in action with a real-world example. One of the best ways to understand how to manage cost variance in your projects is to see how it has played out in real-world scenarios.

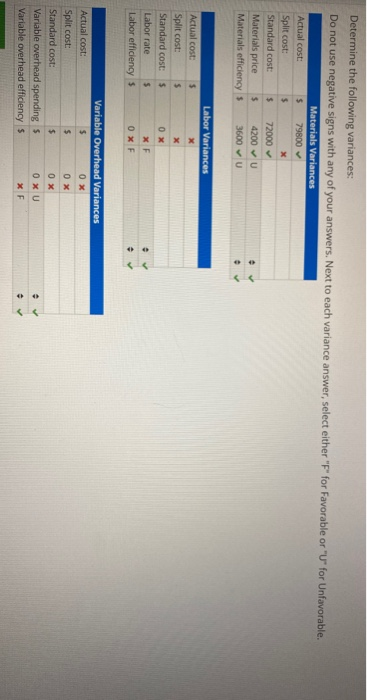

What does materials quantity variance mean?

- For instance, if you’re consistently missing the mark in terms of labor costs, you could examine why the variance keeps happening and use corrective measures to reduce it.

- Cost variances allow managers to identify problem areas and control costs for the upcoming months of business.

- As you’ve learned in this blog post, cost variance is a crucial aspect of project management that can significantly impact your project’s success.

- Now you know how to work out CV, how to use what it tells you and how to address common problems that cause variance.

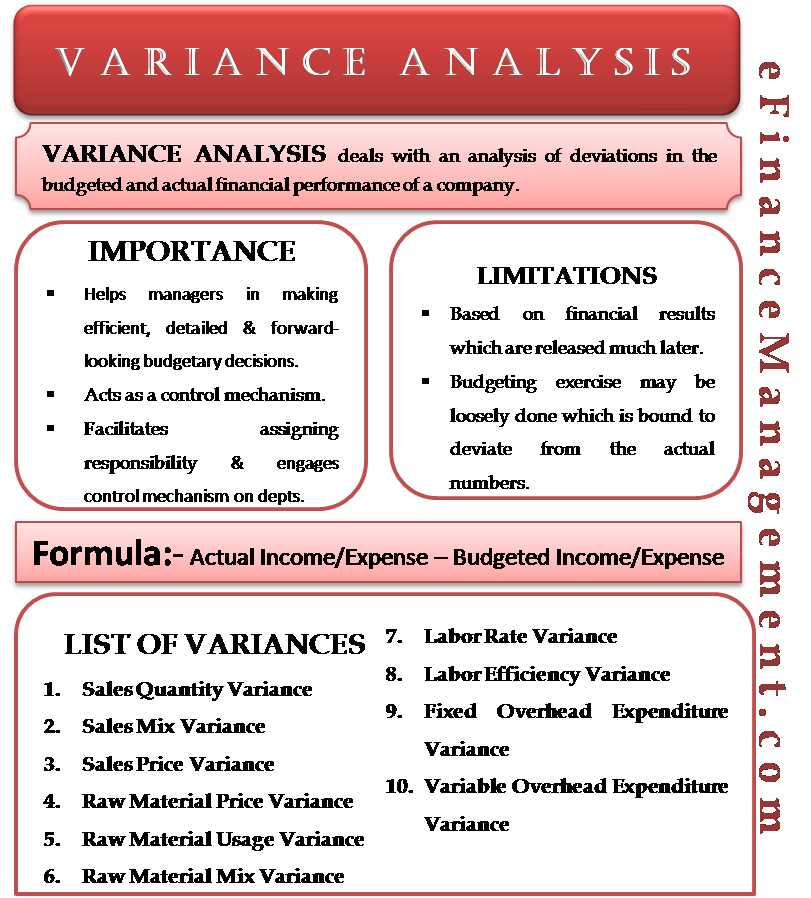

It’s imperative to decide whether to use practical standards or ideal standards. The three categories above describe three different ways to calculate cost variance. Here, we’ll go over the five types of cost variance that you can calculate.

The Relationship Between Cost Variance and Schedule Variance

Rent, property taxes, and subscriptions are all examples of fixed overhead costs. Ideally, the cost variance of a project should be zero, meaning that the expenses haven’t strayed from their planned value. However, this rarely happens as not every project always goes according to plan. The main purpose of calculating the cost variance is to see whether the project expenses are under control and how well the project is performing financially.

AcqNotes Tutorial

It also means that if you have to answer to stakeholders or negotiate budget terms, you’ll have detailed information to support your case. Calculating your SPI can show your progress per task and for the entire project. For example, if you work out the SPI per task then compare it to the overall progress, you’ll be able to see (for example) that you’re on schedule despite two tasks being behind. With SPI, you can get a better understanding of how these tasks impact the wider project. Your software will be able to calculate it for you, and you probably already have monthly reports with it on. When you have the EV figure, take away the Actual Cost – the amount spent on the project so far.

Try the examples below and check your answers at the bottom of the page. This breakdown clarifies something must have happened during Week 2 to cause the negative cumulative CV. Now, you can take a closer look at why this variance happened and how you can fix it. As a potential PMP credential holder, calculating CV is just the first step. Interpreting your results is the next step and will tell you if you are over, under, or on budget.

If labor cost variance is negative, this indicates that your team is under producing, or the project scope is greater than anticipated. Additional training or better quality control measures can help you bring labor costs down. An unfavorable variance is the opposite of a favorable variance where actual costs are less than standard costs. Rising costs for direct materials or inefficient operations within the production facility could be the cause of an unfavorable variance in manufacturing. In this blog post, we’ll delve into the concept of cost variance in project management and how it can impact the success of a project.

If the cost variance is zero, it means that the actual cost of the project is equal to the expected cost of the project. When you’re managing a project, calculate cost variance periodically in order to determine whether your project is staying on or under budget. You can even calculate individual variances for different budget categories, like labor or supplies, in order to find areas that are most likely to push a project over budget. The cost variance formula is a helpful way to keep track of a project’s progress and ensure that costs remain within budget throughout the duration of a project. In this article, we’ll explain the cost variance formula, different cost variance calculation methods, and provide examples of cost variance in action below.

The budget is the expected cost for everything, whereas the standard is the cost per unit of input, such as overhead or materials per unit of output. This standard cost in manufacturing is the expected cost of producing the product, but the budget covers all the units. Standard costs are set by carefully considering amounts determined by experience and the expectations of the managerial staff.

We’ll explore how to calculate cost variance, the relationship between cost variance and schedule variance, and tips for containing cost variance. By the end of this post, you’ll have a solid understanding of this important concept and how to use it to your advantage in your project management endeavors. Labor cost variance is the difference between budgeted and actual costs for direct labor.

Háblanos por WhatsApp

Háblanos por WhatsApp